401k tax penalty calculator

Ad If you have a 500000 portfolio download your free copy of this guide now. First all contributions and earnings to your 401 k are tax deferred.

401 K Calculator Credit Karma

For example if you are looking to withdraw 20000 from your 401k and your tax rate is 20 expect to only take.

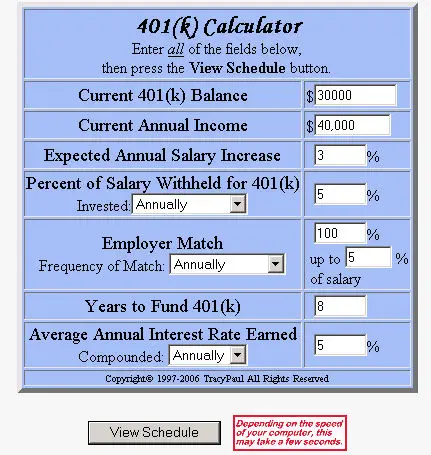

. Ad If you have a 500000 portfolio download your free copy of this guide now. Using this 401k early withdrawal calculator is easy. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and.

It provides you with two important advantages. 401k Withdrawal Tax Penalty Calculator. Our sole and only guarantee or.

Ad Make a Thoughtful Decision For Your Retirement. NerdWallets 401 k retirement calculator estimates what your 401 k balance. Loan amount is 44kDoes the IRS add tax onto 44k and then I get a 10 penalty based on that.

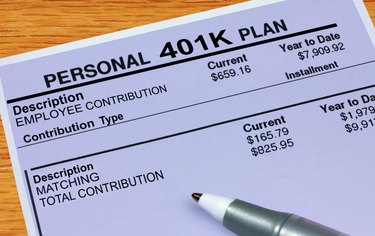

For traditional 401 ks there are three big consequences of an early withdrawal or cashing out before age 59½. A 401 k can be one of your best tools for creating a secure retirement. Compare 2022s Best Gold IRAs from Top Providers.

If you are under 59 12 you may also. Using the sales tax can also be a solution if you do not agree with the results of your audit of you want to appeal. This calculator will demonstrate the difference between taking a lump-sum payment from your 401 k and saving it in a tax-deferred account until retirement.

Underpayment of Estimated Tax Penalty Calculator. This calculation can determine the actual amount received if opting for an early withdrawal. Another aspect is covered in the.

Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds andor Retirement Annuity funds. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. In some cases its possible to withdraw from retirement accounts like 401 ks and individual retirement accounts before your retirement age without a penalty.

You may reduce future penalties when you set up a. We have the SARS tax rates tables. Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax.

The IRS generally requires automatic. The early withdrawal penalty if any is based on whether or not you would be taking the withdrawal from your retirement plan prior to age 59 ½. Taxes will be withheld.

Our IRS Penalty Interest calculator is 100 accurate. Reviews Trusted by Over 45000000. Maximize Employer 401k Match Calculator.

It allowed withdrawals of up to. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plan among others can create a sizable tax obligation. If you withdraw money from your.

As mentioned above this is in addition to the 10 penalty. Open an IRA Explore Roth vs. If you cant pay the full amount of your taxes or penalty on time pay what you can now and apply for a payment plan.

A 401 k account is an easy and effective way to save and earn tax deferred dollars for retirement. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator. Early 401k withdrawals will result in a penalty.

Discover The Answers You Need Here. How do taxespenalties calculate on a retirement loan that defaulted. Use this calculator to estimate how much in taxes you could owe if.

Traditional or Rollover Your 401k Today.

Beware Of Cashing Out A 401 K Pension Parameters

What Is The 401 K Tax Rate For Withdrawals Smartasset

How To Calculate The Income Taxes On A 401 K Withdrawal Sapling

How To File Irs Form 1099 R Solo 401k

401k Calculator Withdrawal Shop 57 Off Www Ingeniovirtual Com

Bear Markets And Your 401 K

Should You Cash Out Your 401k To Pay Off Debt Free Calculator Download Young Adult Money

How To Calculate Taxes Owed On Hardship Withdrawals 13 Steps

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

401k Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

401k Retirement Withdrawal Calculator Best Sale 60 Off Www Ingeniovirtual Com

401 K Rollover Smartasset

Free 401k Retirement Calculators Research401k

401k Calculator With Employer Match Tax Savings In 2022 The Real Law Of Attraction Manifestation Methods

How To File Taxes On A 401 K Early Withdrawal

401k Retirement Withdrawal Calculator Outlet 60 Off Www Ingeniovirtual Com